Comprendre les cotisations employeur : tout ce qu’il faut savoir

As an employee, it’s important to understand the social contributions made by your employer. These contributions are part of the social protection system and play a vital role in ensuring your benefits and rights are protected. In this article, we’ll explore where your employer contributes, how to identify these organizations, and how to obtain information about your employer’s contributions.

Your employer contributes to various branches of social protection that offer different benefits and services. These branches typically include healthcare, pension, unemployment, and occupational accidents or diseases. Each branch has specific requirements and contributions set by the government. It’s important to understand which branches your employer contributes to and how it impacts your social protection coverage.

For example:

- Healthcare: Your employer contributes to the national health insurance system, which provides coverage for medical expenses.

- Pension: Contributions towards your retirement benefits are made by your employer, ensuring financial security during your golden years.

- Unemployment: In case of job loss, your employer’s contributions to the unemployment branch provide temporary financial support.

- Occupational accidents or diseases: Contributions are made to ensure compensation and support if you encounter work-related accidents or health issues.

Identifying the organizations where your employer contributes

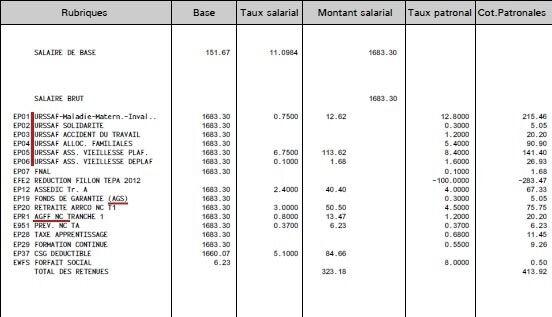

To identify the organizations to which your employer contributes, you can start by checking your payslip. Employers usually mention the contribution details on the payslip, such as the name of the organization or the acronym representing the branch of social protection.

Additionally, you can contact your human resources department or the payroll team to provide you with the necessary information. They have access to employee records and can help clarify any doubts regarding your employer’s contributions.

How to get information on your employer’s contributions?

If you need detailed information about your employer’s contributions or want to make sure they comply with legal obligations, you have several options:

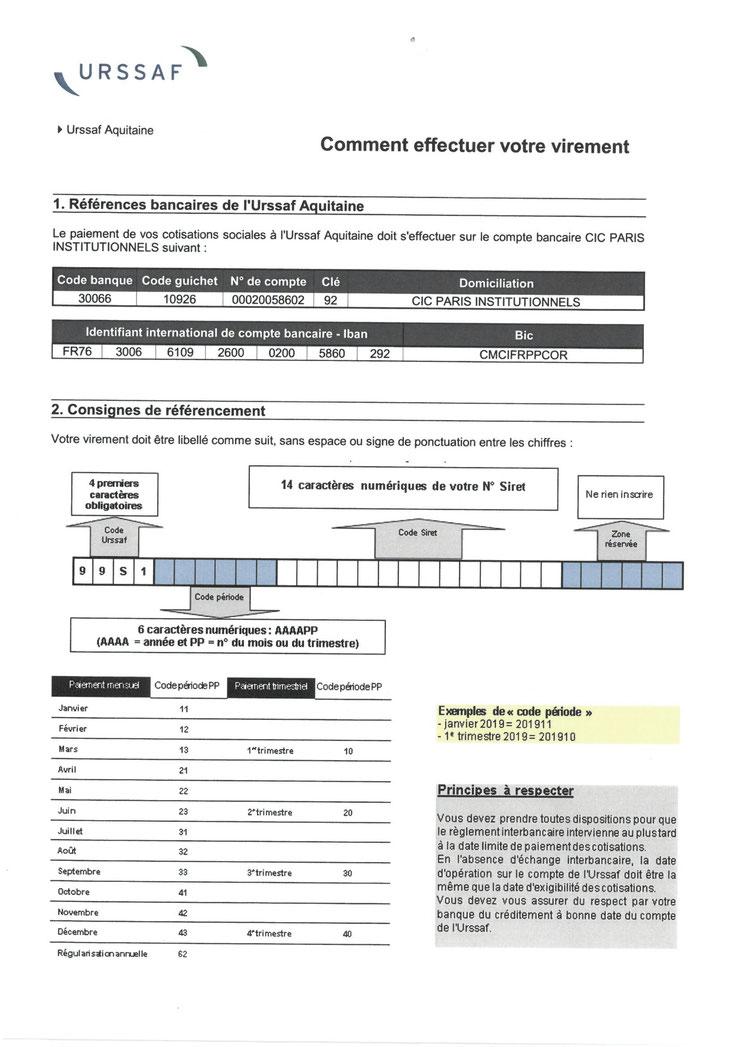

- Contact the relevant social security organization: Get in touch with the organization responsible for managing the specific branch of social protection where your employer contributes.

- Visit the official websites: Many social security institutions have their own websites, which provide information on contributions, benefits, and rights.

- Consult legal sources: Research the national legal framework regarding social contributions to familiarize yourself with the regulations.

- Seek professional advice: If you’re unsure about the information received or have complex questions, consider consulting an employment lawyer or expert in social security law.

Checking your employer’s compliance with legal obligations

Checking if your employer is complying with legal obligations regarding social contributions is essential for protecting your rights. Here are some steps you can take:

- Review your employment contract: Ensure that your contract clearly states the terms and conditions of your employer’s contributions.

- Compare with payslips and bank statements: Regularly monitor your payslips and bank statements to verify that the contributions deducted from your salary match the amounts specified in your contract.

- Communicate with the payroll department: If you notice any discrepancies or have concerns, reach out to your payroll department to seek clarification.

- Report non-compliance: If you have evidence that your employer is not fulfilling their legal obligations, you can report it to the relevant authorities, such as labor or social security inspectors.

Act in case of non-compliance with your employer’s contributions

If you discover that your employer is not complying with their contribution obligations, take the following steps:

- Gather evidence: Collect all relevant documents and records to support your claim of non-compliance.

- Document conversations: Keep a record of any discussions or correspondences related to the issue.

- Inform your employer: Notify your employer in writing about the non-compliance issue and provide them with the evidence you have gathered.

- Seek legal advice: Consider consulting an employment lawyer to understand your rights and legal options.

- Contact the relevant authorities: If necessary, report the non-compliance to the appropriate authorities to initiate an investigation.

Les leçons à retenir:

Understanding social contributions is crucial for employees to protect their rights and benefits. Ensure you know which branches of social protection your employer contributes to and check your payslips for contribution details. If you need more information, contact your HR department or the relevant social security organizations. Regularly monitor your contributions and take action if you suspect non-compliance with legal obligations. By staying informed and proactive, you can safeguard your social protection coverage and ensure your employer meets their responsibilities.

FAQ

Où trouver la cotisation de l’employeur ?

La cotisation de l’employeur peut être retrouvée dans différentes sources, telles que les bulletins de paie, les contrats de travail, les conventions collectives, les accords d’entreprise, ou encore sur le site internet de l’organisme de protection sociale dont relève l’employeur.

Pour savoir si votre employeur verse les cotisations sociales, vous pouvez consulter votre contrat de travail ou vos fiches de paie pour vérifier si les cotisations sont déduites. Vous pouvez également contacter les organismes tels que l’URSSAF, la caisse de retraite ou la sécurité sociale pour obtenir des informations sur les paiements effectués par votre employeur.

Comment savoir les cotisations ?

Pour connaître le montant des cotisations, il faut se référer au contrat d’adhésion ou au règlement de l’organisme concerné. Les cotisations varient en fonction de différents critères tels que l’âge, la situation professionnelle, le niveau de couverture choisi, etc. Il est donc nécessaire de consulter ces documents ou de contacter directement l’organisme pour obtenir cette information.

Comment savoir si mon employeur cotisé au 1% patronal ?

Pour savoir si votre employeur cotise au 1% patronal, vous pouvez demander une attestation de versement à l’organisme collecteur (Action Logement) ou vérifier vos bulletins de salaire pour voir s’il y a une contribution de 1% du montant de votre salaire brut. Vous pouvez également consulter votre convention collective pour connaître les obligations de votre employeur.

Mireille est notre Rédactrice Senior passionnée de mots. Elle a commencé sa carrière en tant que rédactrice indépendante, éditant des livres et créant des contenus web de qualité. Son attention aux détails et son expertise grammaticale sont inestimables pour notre équipe.